Basic Policy on the “Principles for Customer-Oriented Business Conduct”

【Establishment and announcement of policy related to customer-oriented business conduct】

Star Asia Investment Management Co., Ltd. (the “Company”) has adopted the “Principles for Customer-Oriented Business Conduct” announced by the Financial Services Agency as of March 30, 2017, and announces the policy to realize customer-oriented business conduct alongside the status of initiatives taken as follows. The Company will regularly review the policy and status of initiatives to realize better business conduct.

[Pursuit of best interests of unitholders]

As a member of Star Asia Group, the Company will conduct asset management to maximize unitholder value by ensuring observance of the “unitholders’ interest-first” mindset, which is the management philosophy of the Group, and consider the best policy for all unitholders without being bound by stereotypical views.

As the asset management company of Star Asia Investment Corporation (hereinafter referred to as “SAR”), the Company has set the following basic principle.

Basic principle: “unitholders’ interest-first”

Under this basic principle, the Company will take the following actions in an effort to contribute to the maximization of unitholders’ interest.

- ・Investigate all measures considered to contribute to the maximization of unitholders’ interest, without being bound by stereotypical views.

- ・Manage the portfolio with flexibility and agility based on our unique market analysis, focusing on the stability and growth of income.

- ・Conduct highly transparent management by disclosing necessary information to unitholders in a timely and appropriate manner.

Since our Company is solely engaged in the asset management business and is not engaged in the structuring of financial products, we have not established any particular basic principles regarding the structuring of financial products or policies regarding the establishment of governance in line with such principles.

[Appropriate management of conflict of interest]

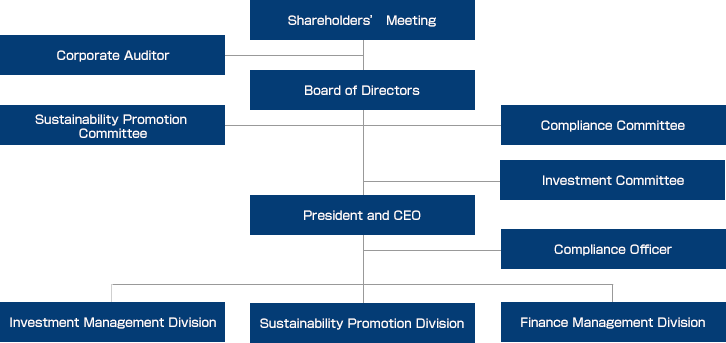

The Company accurately understands the possibility of the occurrence of conflict of interest among SAR and our Company and Star Asia Group in transactions and the possibility of the occurrence of conflict of interest arising due to its management of SAR and will appropriately manage conflicts of interest when there is a possibility that such conflict may occur. The Company has established the “Rules on Transactions with Interested Parties” as a specific policy to handle such conflict. Furthermore, the Company has established a Compliance Committee comprised of third-party members who are able to provide opinions from a specialist and neutral perspective (and whose approvals are required for passing resolutions), as a framework for preventing conflict of interest, and is being properly managed.

As the Company is dedicated to conducting the asset management of SAR, and is not engaged in the sales and recommendation etc. of financial instruments, the Company has not established in particular any policy related to the management of conflict of interest related to the sales and recommendation etc. of financial instruments.

[Clarification of commissions, etc.]

The Company will provide information to help unitholders understand the details of commissions, etc. paid to the Company by SAR, including the type of services for which commissions, etc. are paid as compensation.

[Provision of important information in a comprehensible manner]

The Company will provide important information related to SAR to unitholders in a comprehensible manner given that there are differences between the information held by the Company and those held by unitholders.

As the Company is dedicated to conducting the asset management of SAR, and is not engaged in the structuring, sales and recommendation etc. of financial instruments, the Company has not established in particular any policy related to the organization of a system related to the provision of information for the structuring, sales and recommendation etc. of financial instruments.

[Provision of services suitable for customers]

Based on the basic principle of “unitholders’ interest-first”, the Company will implement various measures determined to contribute to the stability and growth of income from a mid- to long-term perspective. Furthermore, in order to contribute to investment decisions by unitholders, the Company will provide necessary and easy-to-understand information which matches the attributes of unitholders.

As the Company is dedicated to conducting the asset management of SAR, and is not engaged in the structuring, sales and recommendation etc. of financial instruments, the Company has not established in particular any policy related to the organization of a system for making specific structuring, sales, and recommendation etc. of financial instruments and services.

[Framework for appropriately motivating employees, etc.]

In order to pursue the best interests of unitholders, the Company will evaluate each employee's compliance efforts in personnel evaluations. In addition, the Company will continue to provide compliance-related training to increase the professionalism and awareness of compliance of our employees.

In order to encourage self-study among our employees, the Company will provide appropriate incentives, such as by providing subsidies for the acquisition and maintenance of qualifications such as for certified real estate transaction specialists and ARES real estate securitization masters.

【Status of initiative taken for “Principles for Customer-Oriented Business Conduct”】

The status of initiative taken by the Company for “Principles for Customer-Oriented Business Conduct” is disclosed below.

[Pursuit of best interests of unitholders]

The Company will, upon managing the assets of SAR, pursue maximization of unitholders’ interest by making efforts to increase the distribution per unit etc. For details on such status, please refer to the financial results presentation material disclosed in the SAR website.

https://starasia-reit.com/file/en-ir_library_term-2189402c8b07b9913350c7d36ad026ddd62a7923.pdf

[Appropriate management of conflicts of interest]

For details regarding the Company’s initiatives taken for appropriate management of conflicts of interest and the status of transactions with interested parties etc. of the Company, please refer to the section [Restrictions on Transactions with Interested Parties] in SAR’s securities report (available in Japanese only).

https://starasia-reit.com/file/ir_library_term-94ca4f04704ff9500e2d22353ed94241e7818804.pdf

The number of cases related to conflict of interest at the Company deliberated at the Compliance Committee, and the number of times the Compliance Committee has been held are as follows.

|

FY 2023 |

FY 2024 |

| Number of conflict-of-interest cases deliberated |

5 cases |

5 cases |

|

FY 2023 |

FY 2024 |

| Number of times Compliance Committee has been held |

9 times |

8 times |

[Clarification of commissions, etc.]

The asset management fees received by the Company from SAR are comprised of the interim fee I, interim fee II, acquisition fee, assignment fee, and merger fee. Please see SAR’s Certificate of Incorporation for details of calculation methods and upper limit of rates for each fee. Also, for details regarding asset management fees paid to the Company each period, please refer to SAR’s Asset Management Report (Part I: Asset Management Report, 5. Status of Expenses and Liabilities (1) Specifications of expenses related to management etc.) (available in Japanese only).

<Star Asia Investment Corporation>

SAR’s Certificate of Incorporation:

https://starasia-reit.com/file/en-about_articles-57f172e6d71094d9a8254916cccdf02c330d33e8.pdf

Asset management fees:

https://starasia-reit.com/file/ir_library_term-beb1543e6ab3285d0fee7f3407b3ce2db05c723b.pdf

[Provision of important information in a comprehensible manner]

With respect to the status of provision of important information through comprehensible channels, information meetings targeting institutional investors and analysts are held for the end of SAR’s each fiscal year, where financial results are reported and business forecasts for the following and next following business years are explained. Regarding the contents of such information meetings, the materials disclosed at such meetings as well as the video clips of such meetings are disclosed on SAR’s website. Furthermore, after the financial results are announced, the Company conducts IR activities towards institutional investors in Japan and abroad. For individual investors, information meetings targeting individual investors are held, and the Company also participates in individual investors’ seminars held by securities firms and various industry associations and explains about the financial results of the Company at such meetings as well. Also, Star Asia’s official channel has been established on an online video service platform (YouTube), where information regarding SAR is described.

<Star Asia Investment Corporation>

Financial results related materials: https://starasia-reit.com/en/ir/library.html

Press releases: https://starasia-reit.com/en/ir/index.html

Star Asia Group Official Channel: https://youtube.com/channel/UCYasJn4xrns2fhyZFKMAELw?si=6S4a0evYeaxaf6JX

[Provision of services suitable for the customer]

With respect to provision of services suitable to customers, efforts are made to understand the information required by investors through IR activities and taking surveys at the information meetings held for individual investors, and the necessary information that suits the attributes of investors is provided in a comprehensible manner.

<Star Asia Investment Corporation>

Financial results related materials: https://starasia-reit.com/en/ir/library.html

Press releases: https://starasia-reit.com/en/ir/index.html

|

FY 2023 |

FY 2024 |

| Explanatory meetings for analysts and institutional investors |

6 times |

6 times |

| Explanatory meetings for individual investors. |

4 times |

9 times |

| IR Event |

3 times |

10 times |

| Number of contacts with investors (including phone calls) |

103 times |

132 times |

[Framework for appropriately motivating employees, etc.]

The Company conducts advanced employee training etc. by inviting outside experts in order to promote behavior to pursue the best interests of unitholders, fair treatment of unitholders, and appropriate management of conflicts of interests, and conducts study sessions at each department as necessary, and ensures observance of fiduciary duties.

Number of company-wide employee training sessions held

|

FY 2023 |

FY 2024 |

| Number of company-wide employee training sessions held |

9 times |

7 times |

The Company also recommends its employees to acquire the qualification called “Certified Master of Real Estate Securitization” sponsored by the Association for Real Estate Securitization (ARES) in order to enhance the specialist skills of employees.

The number of qualification holders and percentage of holders

|

As of Jan. 31, 2024 |

As of Jan. 31, 2025 |

| Number of holders |

% of holders |

Number of holders |

% of holders |

Certified Masters of the Association for

Real Estate Securitization |

6 |

30% |

6 |

30% |

| Certified Public Accountants |

1 |

5% |

1 |

5% |

Real Estate Transaction Agents

(including those who have passed

the real estate broker (taken) exam) |

14 |

60% |

14 |

65% |